New data from the Office for National Statistics (ONS) shows that the average house price in England’s Second City of Birmingham is up 5.3% year-on-year in May 2025. That’s according to the ONS’ provisional figures that suggest a typical sale in Birmingham reached £234,000.

Interestingly, this represents higher year-on-year growth than the wider average of the entire West Midlands (3.5%). Yet average house prices in Birmingham are still considerably lower than the West Midlands average, which sat at £244,000 in May according to the ONS.

Exploring the types of properties in most demand in Birmingham

When we break down the ONS data by property type, average sale prices in Birmingham as of May 2025 reached £438,000 for detached properties and £272,000 for semi-detached properties. Prices were lower still for terraced properties (£219,000) and flats and maisonettes (£153,000).

According to SellHouseFast, a house sale platform that helps property owners to sell a house fast in Birmingham by providing quick cash offers, private rents stood at £1,003 in July 2024. The ONS revealed last week that average private rents have continued to rise to £1,059 as of June 2025. However, the data also showed that private rental price annual inflation in Birmingham was at its lowest level since May 2023.

Although average rental prices rose in Birmingham by 6.7% year-on-year in June 2025 – markedly above the West Midlands average – rental values in Birmingham are still well down on the English and UK average. In England, the average rental value for a private property now stands at £1,399, compared with £1,059 in the Second City.

One-bedroom private rents have risen most in the last 12 months to June 2025. The typical one-bedroom flat or maisonette in Birmingham has seen rents rise by 7.1% on average.

At the other end of the spectrum, four-bed detached properties have seen private rents rise at the slowest of all property types in the year to June 2025 (5.4%). Rental properties in Birmingham with four or more bedrooms now cost an average of £1,529 to rent per month.

Assessing Birmingham’s first-time buyer market

In May 2025, the average provisional sale price paid by first-time buyers in the Second City stood at £212,000. That’s up from £201,000 in May 2024. Average house prices for first-time buyers in Birmingham have risen above the West Midlands average in the last 12 months.

The West Midlands average now stands at £207,094 compared with £212,314 in Birmingham. The average house price paid by first-time buyers in England for May 2025 was £243,068, significantly above the UK-wide average of £226,673.

For contrast, the typical price of a mortgaged home purchased in Birmingham (£239,000) in May 2025, up from £227,000 in May 2024.

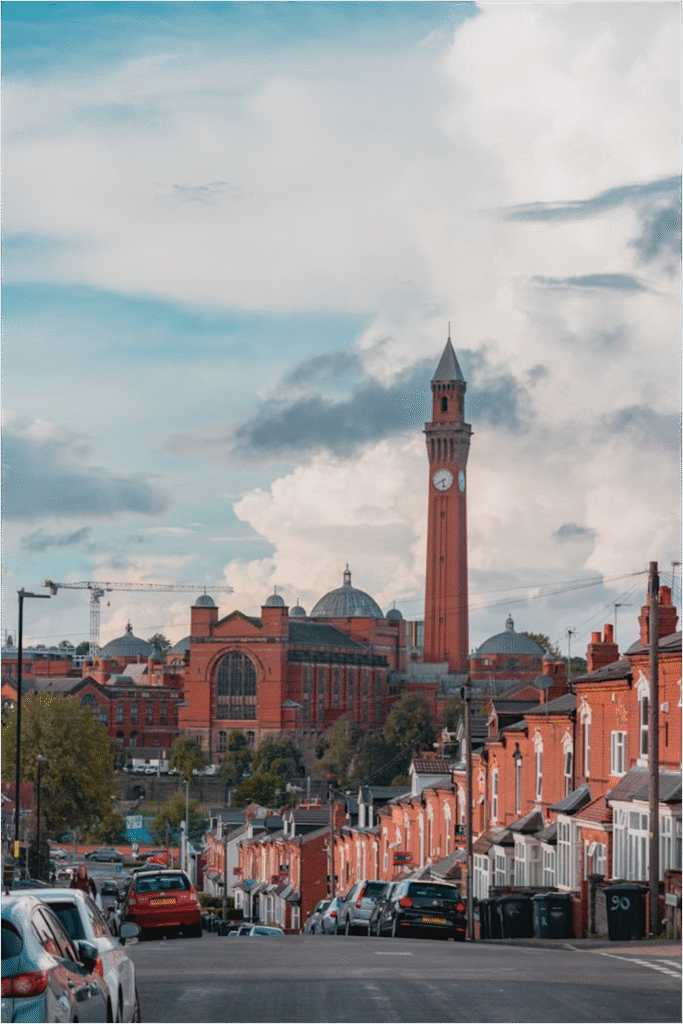

There are many reasons why the first-time buyer market is growing well in Birmingham. The city’s economy is showing durability in the face of adversity, attracting more young professionals to the area.

While leaders at the University of Birmingham warned earlier this year that the UK is at risk of becoming an incubator economy, they also said that Birmingham’s start-up culture was strong. They sighted professionals in the tech, advanced manufacturing and healthcare technologies sectors as being particularly keen to move to and thrive in the area.

Read More: click here